Here is the study (pdf).

The study also criticizes that social and environmental risks persists, e.g. in Chinese-funded battery plants in Hungary, where "a number of health & safety breaches have also been recorded and working and living conditions of migrant workers are described by some as “modern day slavery”, the study says.

Summary:

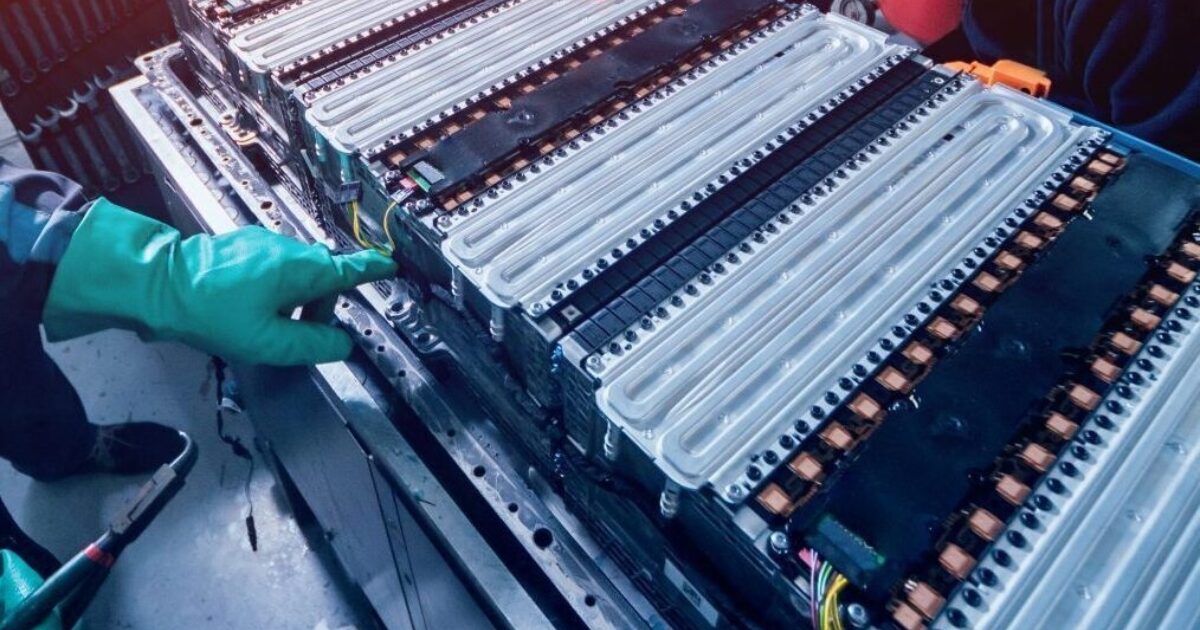

Europe’s ambition to build a world-leading battery industry is facing many headwinds. As local plans falter, over 90% electric car and storage batteries are produced by South Korean and Chinese companies in the EU. An additional 40% of announced battery gigafactories are from these companies, who are global leaders in the technology and more likely to succeed.

Many European carmakers are entering partnerships with Chinese battery players to secure the supply. But there are concerns about the environmental and social conditions under which some of these facilities, e.g. CATL battery plant in Hungary, are operating. Critically, as homegrown battery companies struggle, will the upcoming partnerships with foreign battery leaders enable the EU to gain the expertise we lack? Is it the road to becoming a battery powerhouse or an assembly plant?

T&E has commissioned a study to Carbone 4 and independent experts to find out. The study analysed the environmental and social conditions in the CATL battery plant in Hungary and the LG one in Poland, as well as the technology transfer provisions in the VW-Gotion and CATL-Stellantis battery partnerships. It finds that:

While hundreds of millions were given to these two factories alone, environmental and social risks persist:

- Together, the two Asian factories analysed received at least EUR 900 mln in state aid subsidies from the Hungarian and Polish governments, often drawn from the European post-covid recovery fund. However, no environmental or social conditions were attached by the European Commission, or auditing performed.

- A clear breach of the EU’s Industrial Emissions Directive on air pollution was found (but unclear if governments given derogation), as documents show that both factories exceed the EU limit for NMP, a toxic substance used in cathode manufacturing. In addition, poor water management plans and questions around the ability of the host countries, notably Hungary, to provide sufficient energy were raised.

- Precarious working and broader social conditions were also noted in Asian factories in Hungary. This is largely due to an insufficient local legal framework around temporary contract workers under which thousands of migrant workers in battery factories are hired. A number of health & safety breaches have also been recorded and working and living conditions of migrant workers are described by some as “modern day slavery”.

Upcoming Chinese-EU battery ventures lack local knowledge sharing

The analysis, largely relying on external experts due to the lack of public data, also looked at decision making, technology/skills transfer and other key conditions in two recent partnerships. It finds that:

- No EU-wide (or national) requirements on technology transfer, local content or other conditions in joint ventures exist in Europe. This results in pure business to business (or member state to China) agreements focusing on short-term battery supply.

- While VW invested EUR 1.1 billion into Gotion and holds 26.47% of shares, it is said to have less significant say in battery operations. Experts point out that the partnership is more about securing LFP battery supplies to VW’s European operations, than comprehensive knowledge or IP transfer to Europe.

- Taking the form of a 50-50 JV, Stellantis and CATL were offered EUR 300mln in state aid for the planned LFP plant in Zaragoza, Spain. No conditions on technology or skills transfer were attached to this subsidy.

- Despite very little information available on the latter JV, expert after expert has pointed out that it is about supplies, not technology transfer: for Stellantis, the main goal appears to be access to the LFP battery technology to supply electric cars on the EU market.