My salary didn’t change at all, but homes went up 82%. The money I saved for a down payment and my salary no longer are good enough for this home and many others. This ain’t even a “good” home either. It was a 200k meh average ok home before. Now it’s simply unaffordable

I like the utility feed hanging off the front of the house going straight through the roof and blocking them from installing the other fake shutter. I wonder what other construction horrors lurk inside.

About everywhere… In Toronto it’s now 1 million+. In Vancouver it’s now 2 millions+

Right but OP is talking about a house in Waleska, Georgia, which has a population of 921 (as of 2020 census). Not really on the same level as Toronto or Vancouver!

People from big city retire, sell their house now worth a fortune and move out of the city and can afford to pay whatever people want for their house, this inflates the price of housing in rural areas and people born there can’t afford to live there anymore.

Hi, Georgian here. Trust me, nobody wants to live in the ass-end of Cherokee County, so far north it’s only barely in Metro Atlanta, but not far enough north to have decent mountain scenery or anything. Frankly, I’m appalled at how overpriced it was at $200K four years ago, let alone now.

People move out of cities just to have a bigger lot around their house. Hell over here arable land is getting scarce because people buy any agricultural lot that has a house on it just so they have space, doesn’t matter that it’s in the middle of nowhere with nothing to do and doing the grocery means an hour of traveling, they have the time to take their car and travel but they certainly don’t want to exploit the land they just bought!

Has the population jumped up for ya guys?

Don’t know about them specifically, but it seems that more than anything real estate investors are just grabbing as many properties as they can find, whether they can get tenants or not. A house goes up for sale and it’s bought sight unseen by a company almost instantly.

That’s crazy

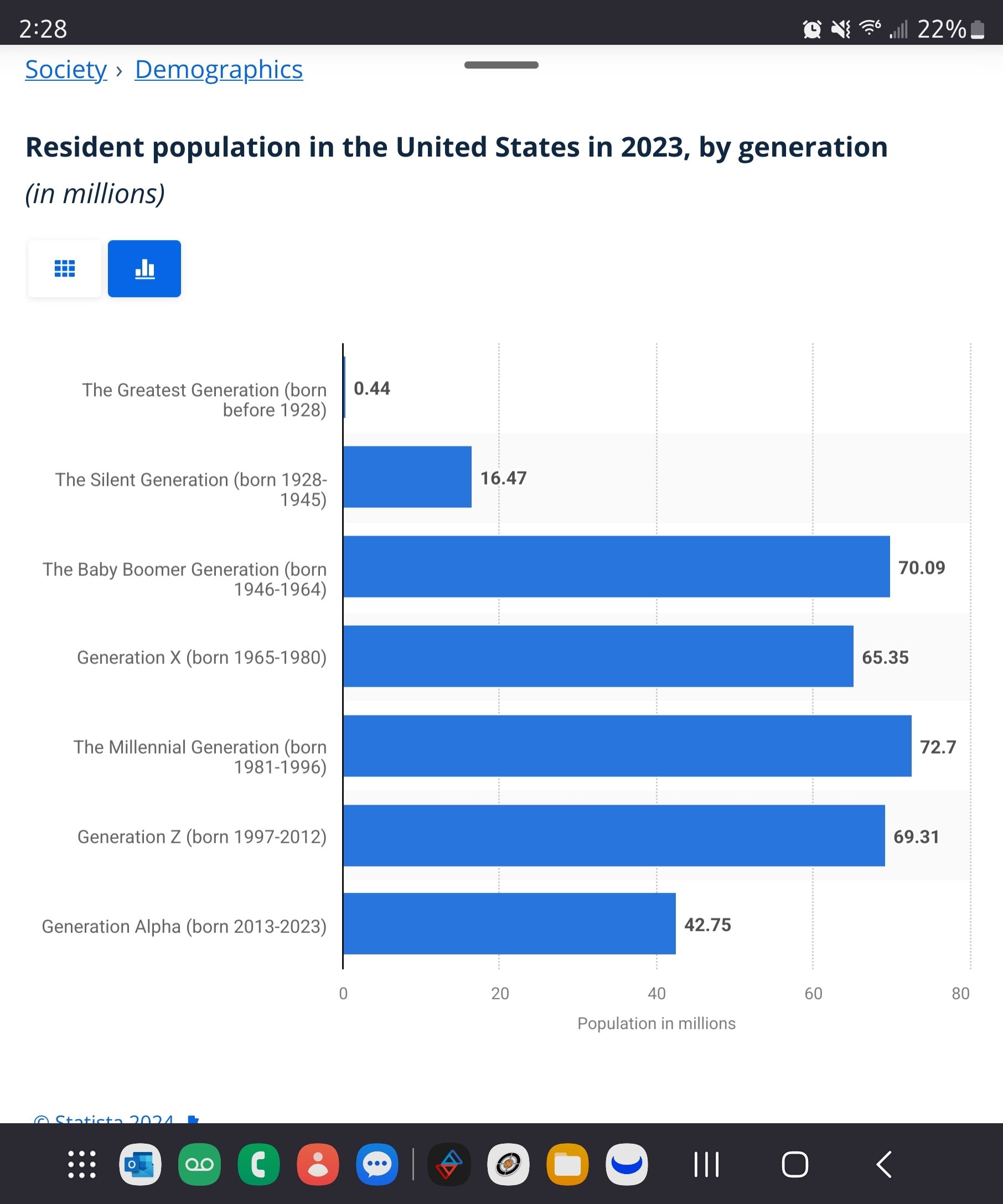

Yes the largest generational share of the population is the millennials most of whom are just becoming the age of the average first time homebuyer. Creating a sharp spike in demand for realestate.

Ya but does that happen with every generation then? Having a sharp spike of first time homebuyers.

Most millennials would be buying homes already. The end of the millennial group is coming up on 30 so I wouldn’t expect them to be the driving force for first time buyers when so many are already established

I’ll have to look it up to he sure but I wanna say millenials were the largest population increase for a generation since the boomers. Which would make up the really close to the entire existence of the eealestate market as we know it. Wanna say 1930’s the new deal created the foundation of the modern mortgage loan. Either way, the answer is no it does not go up for every generational transition.

It’s actually only the second time it has and will go up by the time gen z cycles to home buying in a span longer than 150 years.

I wanna say you were thinking of this in terms of total population growth increasing but it really is more of a combo between birth rate and poulation percent change, except instead of year over year it is 15 year wondow over 15 year window or however long each generational span is.

Work from home is the ultimate culprit.

A. People can migrate and buy in cheaper parts of the country and maintain jobs that would have required them to stay in a certain geographical area in the past.

B. Work from home has gutted the commercial real estate market. Leading investors to move into the home market. You’re going to see a lot of money flow into single family homes to rent over the next ten years.

You’re now competing against established professionals who are later on in the careers and institutional investors.

100% WFH jobs have rapidly dried up. They’re not super common like they were in 2021-2022. Most places either went back to the office or require a hybrid setup (x # of days in office every so often). I won’t deny WFH jobs have definitely contributed to a general rise in home prices in some areas, but I’d need to see data proving it is heavily contributing to a rise all over.

One of the missing pieces that was mentioned by someone else is the purchase of residential properties by businesses being at all time highs.

WFH is efficient and makes sense in many cases. Private equity firms buying homes and holding them to sweat out the market far beyond what a solo landlord could or would, does not.

Oh, I 100% agree that one of the biggest issues is due to corporate mass house purchasing and squatting. But my understanding was that is a problem in some large metros and the surrounding suburbs around those. For example, in San Francisco, much of the issue is due to NIMBY laws preventing high rise condos/apartments in many areas of the metro, which artificially suppresses the supply of new housing.

Really, there isn’t an all encompassing, singular reason that’s driving up the prices everywhere, but a multitude of them. It’s a difficult problem to tackle, but it’s incredibly frustrating that most governments (local, state, and federal) thus far have made barely any effort to address it.

This is everywhere. I’ve been looking for houses for 3 months in NW Ohio. 300k is the new 150k, and all the houses are beat to shit on the inside needing 50k just to make them passable inside because nobody takes care of them.

I wonder what proportion of it is also due to people fleeing 1 million + average house markets during the pandemic work from home wave. Not saying this about you, but it makes me think it’s funny how the common refrain of “Don’t like it? Just move” is often uttered by NIMBYs.

I think a big part of it is we’re on the other side of the peak of all houses going for 100k over asking regardless of condition. A number of houses have that grey vinyl flooring installed in a bunch of rooms that’s as cheap as it is ugly.

grey vinyl flooring

I hate that shit even more than I hated the fake wood paneling and shag carpet of the '70s. I bought a house last year that had the grey vinyl flooring in the living room and I’ve tried my hardest to fuck it up during the renovation so I have to replace it, but unfortunately it holds up to extreme abuse pretty well.

A former housemate did so much water damage with a portable A/C unit, that not even two months ago I had to rip up the whisper walk, and the original wooden flooring (house was built in the '30s) all the way down to the subfloor. Replacing the whisper walk would have been $3000 for just that room. We managed to find vinyl flooring that matched the rest of the flooring in the house and redid the floor for $1500.

My point is that you can get nice vinyl flooring, and it’s not terribly expensive to replace/ install.

Heh, according to the guy who sold me the house, he had to put the grey vinyl flooring in because of water damage from a portable AC unit.

Real talk, forget about a down payment. There are a bunch of different ways to get a 0 down mortgage with varying qualifiers so that chances you qualify for one of them is quite decent.

Even if not, there are still a bunch of other ways to get low down payment mortgages for ~3% down or less.

Toss out the old adage of “20% down or bust” and keep any money saved towards it for savings for all the other costs of home/closing

What income to loan ratio are you talking here?

This is terrible advice. Paying anything you can up front saves you several times over in the long run.

Let’s talk 500k house, 6%, 30 years, no pmi, no taxes, no extras…

Paying 100k (20%) up front you’ll pay: $863,352.76

Paying 50k (10%) up front you’ll pay: $971,271.85

Paying 0 up front you’ll pay: $1,079,190.95Paying 20% down (100k) will save you over 200k.

If you intend to live in the house indefinitely, you’re so much better off if you put as much into the down payment as you can.

Edit: List formatting

This is terrible advice. Paying anything you can up front saves you several times over in the long run.

Usually, yes, but it’s situational.

For example, I bought my house in 2009 during the depths of the Great Recession, with no down payment, and got a screaming deal. If I had decided to wait a few years to save up for a down payment, I would’ve been 500% screwed.

(That “500%” isn’t hyperbole, by the way: that’s how much more I would’ve had to spend to buy my house now instead of back then! Actually, I’d have been even more screwed than that, considering that I’d be paying ever-increasing rent the whole time, too.)

This presumes you can elect to either just spend the 100k now, that you may not have.

If you declare you want 100k, but let’s say that would take you 10 years (and the goalposts wil move). That’s likely 120 months of rent you will have to pay, so while you’ll end up saving on interest, you’ll more than lose out on rent.

Paying down aggressively and going with as big a down payment as you can reasonably afford makes sense. However waiting to save up for that downpayment may cost more in rental expenses than you’d save.

Good thing what I actually said was

Paying anything you can up front saves you several times over in the long run.

My point was that the advice was terrible. Not that there are other circumstances that could make it useful. Overall, as a general rule you shouldn’t want to just hold onto debt for no reason if you have means to pay it down. It’s also why I specifically showed 10% as well rather than just the typical 20% downpayment, it furthers my point that

you’re so much better off if you put as much into the down payment as you can.

“As much […] as you can” And not just some 20% or whatever magic number.

While true, I was thinking more about how the person you replying to probably was reacting to the trend of people talking about saving and waiting until they had a reasonable downpayment before they would consider entering the market, and how the market keeps running away from their downpayment savings.

The ‘never make a downpayment regardless of context’ would be bad advice, but I just presume there is a context in mind about not even having the downpayment to start with and being stuck on the rental treadmill as a result.

That’s great, in theory. In reality, you’ll get stuck in a perpetual savings cycle like OP and in many cases never reach the mythical threshold.

200k savings sounds nice, but if you have to spend 5 years saving and housing prices jump 80, 90, 200% in that time that savings lead gets entirely erased.

You can always play around with your interest rate later on, but you can never change what you paid for the house

housing prices jump 80, 90, 200%

Happened once and we are currently dealing with the consequences., tbd

Also pay on time and as much as you can. Don’t fall into the trap of paying to close to or at the minimum. If you do that you will be in loads of dept.

The longer you wait to pay something off the more interest it gains.

Y’all realize this is a bubble, right? I almost feel sorry for these investors, gonna have their ass handed to them in the coming decade.

The rental aspect isn’t a bubble. Until they start viciously taxing single-family home rental, home prices are going to stay high because they’re not being bought as homes but as assets for rent-seeking.

I feel sorry for any one whose bought a house over the last couple years.

I don’t, it’s strictly better than renting

There are advantages I’m not actually culpable for all of the maintenance of my property my actual rent right now is just about on par with anybody who is going to be paying to purchase their house and granted I’m not actually gaining anything as far as property value I also didn’t have to come up with a down payment or jump through hoops and try and get the house in the first place and very safe in my position and I’m very capable at this point after having lived here for many years landlord hasn’t asked for a new lease in the last couple years so I could actually walk away at any moment… there are benefits but they’re few

Is it though? My understanding is it’s more complicated than “simply better”. You need to account for property tax, home repairs, lack of mobility, housing market, etc.

The main downside is you have to pay closing costs to move. That means you should plan to stay in the home at least a handful of years or else you’d lose money likely. But with the market the way it is, get a house ASAP cause its going up like a roller coaster.

I bought mine 5 years ago and its gone up 50% in value since then.

It’s more along the lines of “buying is generally better than renting, but there are about 100 different factors to consider.”

My mortgage is significantly less than my last apartment down the road. $2700 vs $2100. Same size living space (1000sqft, 2bed), an extra basement, and I get to live in a marginally more affluent area. That difference in monthly payments more than covers monthly housing maintenance costs. And property tax is already included in that $2100 mortgage, which is how it is usually handled in my state.

And you get equity instead of throwing away your income to a faceless real estate corporation for no gain. Owning a house is 100% better in every way, unless you need to quickly move for some reason.

But even then, it’s rare to see a house be on the market for more than a month, MAYBE two before getting sold. You can move out on a couple months notice, instead of having to wait for your annual lease to run out.

But when you do move, you sell your house for ✨ profit ✨ because the housing market only goes UP for some retarded reason.

I’ve helped three friends and coworkers navigate buying their first house in the past couple years. They are all better off financially for it.

Bought a house 5 years ago. Cheaper than renting and equity says I made 100k. It’s good.

It’s just lame how expensive they are now. BTW, they were to expensive 5 years ago too.

Y’all realize this is a bubble, right?

Can you explain why you feel that way?

If Big Macs, houses, gas and college tuition all went up, it’s time to realize these are not all in bubbles and instead realize due to inflation your salary has been halved.

No true! Plebs got 12% raises over last few years ans even for one quarter outpaced inflation 🤡

Not really. The system will instead keep finding ways to get people to rent at higher prices or take out low down payment loans with ever larger monthly payments taking a lot more of take home salaries and making it harder than ever to save and invest.

It depends on the area. Some places are actually gowning that fast in population

Shout out to [email protected]

Didn’t think I’d ever see Waleska on Lemmy… but, yeah. This is just the story all over North Georgia right? No one wanted to live in the mountains until all of the sudden you could work from anywhere. Now everyone earning city and suburb pay is happy to live an hour farther out than they were before.

mine is now worth 130% of its original value

Keep in mind that inflation has risen over 30% in just the last 4 years, which explains at least part of the rise in prices. I wouldn’t be surprised if inflation is even higher in certain areas of the country. I’d also not be surprised if Georgia is getting a lot of natural disaster refugees from places like Florida.

The other part i don’t see anyone mentioning is that this was all projected as a result of millennial generation, the largest % of population by generation comparison, came into the age of buying homes. Creating a sharp spike in demand over supply.

So occasionally I look out of curiosity and the reason is pretty plain.

I look for houses for sale in a suburban area as public listings, and there’s like 1 within a few square miles of the area.

I switch over to renting, and there’s like 12 houses just like the one for sale available, all owned by companies. I also know a coule that aren’t listed that have no tenants, but are still owned by one of those companies. You can tell because those yards are now waist deep grasses (in an area where HOA throws a hissy fit if your yard looks just a smidge unkempt).

Don’t know why the companies find it more profitable to buy houses people aren’t looking to actually move into, at least at the rent they are willing to accept. If I fully understood why, it might just piss me off more. Like maybe the houses work better as a loan basis than other assets, so even empty and unused they are valuable as some sort of financial trick.

Don’t know why the companies find it more profitable to buy houses people aren’t looking to actually move into, at least at the rent they are willing to accept. If I fully understood why, it might just piss me off more. Like maybe the houses work better as a loan basis than other assets, so even empty and unused they are valuable as some sort of financial trick.

That’s one thing, but housing has been a low-risk investment for a long, long time. If they bought the house OP posted in 2020 and sold it in 2024 they would have almost doubled their money even without renting it out.

My understanding is that these companies are investment companies that need stable assets for their billions of dollars portfolios and they actively look to keep buying property as a stable form of appreciating asset. They have so much money that needs to find some way to make more money for their investors.

Yep, that’s on track! My house has almost tripled in price since I bought it 12 years ago. Denver metro. No way I could afford it if I had to buy it today.

Houses in my neighborhood are up 150-200%.

A lot of boomers are going to die in the next ten years or so. That is the biggest age demographic in the u.s. the population is going to shrink by a lot. That’s why there’s a push to make people have more kids, because otherwise workers and consumers have a lot more power.

Private equity is already gobbling up the houses. Boomers are cashing in to finance extravagant retirement. Those who are not, are leaving it to their children who will then sell to private equity groups.

Eventually supply will catch up with demand which will supress rent (if we do something about the price fixing) and it will no longer be a viable investment. They’re probably losing a lot to management costs and capital expenses already.

Single-family rental is also a huge thing now.

I work in municipal development, and since 2021, 100% of single-family subdivision developments that have approached the city have been for rental-only neighborhoods.

And they want to put all the homes on a single shared commercial water meter on a single piece of property instead of extending public lines, so they can’t even be converted later without massive infrastructure projects and replatting.

Eventually supply will catch up with demand

Not if NIMBYs have their way. We have a MASSIVE supply problem already, and it’s getting worse.

Where I am it’s more profitable to let it sit empty and make a Tax write of than lowering the asking rent.

Not exactly a good business strategy. You can deduct the taxes, insurance, management costs, but you have to amoratize depreciation of the building over 28 years. Not to mention that an empty house is going to start developing problems fairly quickly.

if we do something about the price fixing

Narrator voice: they didnt

Being able to buy a $200,000 house in the town I live in would change my life so much.