The only people it’s worth it for are the connected billionaires who can scoop up assets cheap while the rest of us end up as serfs.

Unhinged.

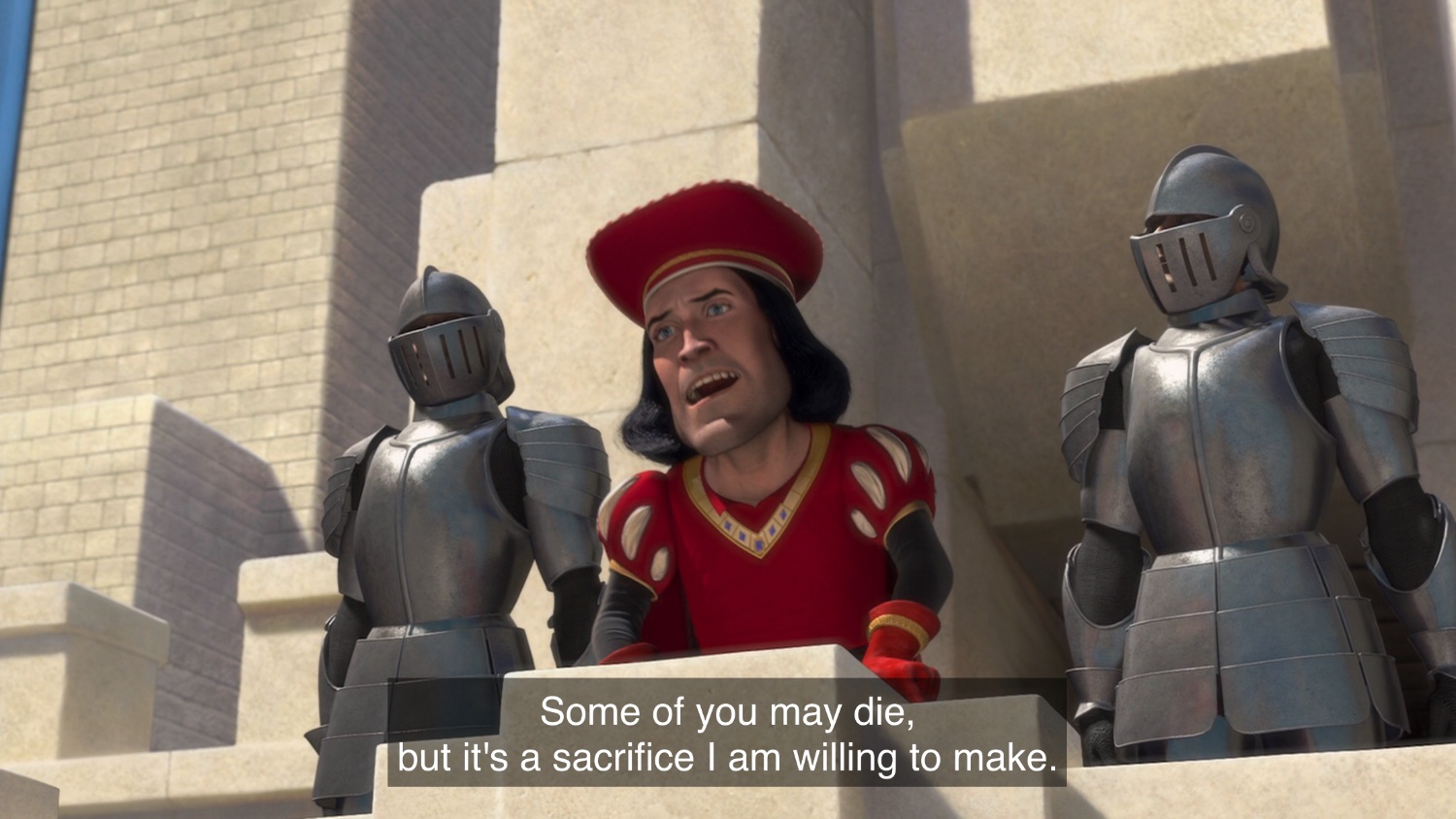

Trump says, “kill camps might be worth the cost.” Human rights activists disagree.

Anything is worth the cost when you aren’t the one paying the cost.

Have to commit since he doesn’t know how the fuck to fix it.

Crashing the economy is literally the point, then his rich asshole friends can acquire a ton of stocks and property while its value is low and when the adults fix it 4 years from now all his friends that got him elected will still win.

deleted by creator

I exchanged a bunch of US stock index funds for international stock index fund a week or so ago.

Moved a bunch of mine into SPAXX until I feel the bottom is close.

deleted by creator

Ooooh thanks for the heads up!

Moved my retirement funds after I found out the index I was in invests in Tesla…

Thought about using the foreign index, just so I could make jokes about all my money being tied up in NICA like in Aqua Teen

If you’re confident in decline, you can invest in inverse stocks. They go up when the main stock goes down. Think there are even inverse index funds.

“I’m going to make the economy better by day one!”

“It’s hard to predict how the economy will go”

“It’s just an adaptation period it will get better”

“It’s not going to be that bad”

“It’s bad but it’s all Biden’s fault”

“It’s going to be worse but it will be worth it” <— you are here

“It keeps getting worse but it’s because everyone is preventing me from going all the way with what I’m doing”

“It will all be fixed once I invade Greenland”

“I need a third mandate to fix this country that Biden has broken”

“It will all be fixed once we invade Canada”

“I had no choice but to call air strikes against these American citizens. They were not peaceful protesters, they were violent secessionist terrorists”

“I declare all journalists terrorists and ordered for them to be shot on sight”

“We are about to achieve a great victory against the secessionist forces that are surrounding the capital”

“Please don’t let them shoot me”

Did you just write the backstory to the Civil War movie by A24?

…for his interests. He always forget to complete the sentence.

I’m glad I sold all my US index funds last month.

Trump hates America

Better yet, he’s making everyone from every other country hate America as well. And since 70% of Americans either voted for him or couldn’t be bothered to vote (same as voting for him), American people are being blamed for being supportive of him.

He did warn us that we’d get tired of winning.

The rich pick up assets during g every crash, widening inequality. We need a wealth tax to start reversing some of those gains

deleted by creator

There’s also the option of additional tax brackets for those wealthy whose income still counts as income. Why do the tax brackets stop? Massachusetts has one set $1M that’s doing pretty well

Because most of the 1% wealth isnt in the form of wages (hence why people say working class vs wealthy sometimes).

Sure you could increase the income brackets, but I think (would need to double check) that wealth tax would make a larger impact.

Sure, but we know income taxes work, we have a mechanism for collecting them, and we already have a ladder of brackets that are completely logical to extend.

While I’m also for some sort of wealth tax, I think that will be much harder to even define, much less implement. There are a lot of loopholes that need to be plugged, an entire industry for the purpose of finding those loopholes, and no objective way to even quantize unrealized gains

deleted by creator

Yes, absolutely. Coming out of the great depression we clawed back so much, but that’s been slowly dismantled and we’re back in the roaring 20s now

Things are more complicated now, but there’s certainly ways to do this if we have politicians who will fight to carry out our will

deleted by creator

https://en.m.wikipedia.org/wiki/Sealioning

ARF ARF ARF I’m just asking questions

deleted by creator

I don’t know that I agree with the conclusions of the video. But TLDR just did a video outlining some history in UK and concluded ones off wealth taxes have worked and listed two examples

deleted by creator

I mean… Fuck economic theory, the entire field is a mess of myths and narratives. There’s good work to be sure, but governments and organizations just find models that support what they want to do, no matter how much it conflicts with observations

There’s historical examples in this country, there’s modern examples like the Scandinavian model… Wealth was redistributed, there’s

I have no idea what you’re asking for. What even is a wealth tax “working” to you?

I mean I could pull up some economists who go over numbers and adamantly advocate for wealth redistribution, but I feel like nothing I give you is going to actually change your mind

deleted by creator

Tax companies revenue first. It would be at a lower rate then profit but also doesn’t allow them to hide the profit.

I never said anything about income tax… But again, these are real things that we used to have and they have elsewhere:

Tax brackets to to 90%+ on business profits - incentivize companies to reinvest in r&d while disincentiving investment

Tax inheritance and crack down on forever trusts

Progressively tax money moving in and out of the country, and close up tax loopholes (killing the tax filing industry would be a necessary prerequisite)

You could even revamp capital gains and certain types of loan to somehow figure into a progressive income tax

And most importantly - this has been done before. It has been done, you can pick apart suggested methods and come up with excuses for why it’s impossible… But it’s so clearly not. Everything else is an engineering problem

If you want to hear economists talk about it, Garys economics on YouTube popped into my feed a few days ago. He’s far from the only one, even Warren Buffett has gone through a plan where he says the full tax burden could be put on businesses

And if you want to know why I don’t respect economics… It’s not because I’m not read up on it, it’s because: how can you read up on it and still think taxing the wealthy is impossible? This has been written about by economists for decades, but it doesn’t matter because there’s more convenient economic theories to push far and wide

deleted by creator

The Netherlands has had one forever, and it is not in economic collapse AFAIK.

deleted by creator

We need a tax on unrealized gains over a certain amount (as to not screw the 99%).

Wealth tax over $10M or even 100M would still do massive good. If we can hit billionaires and reinvest that in the working class, the economy is going to go crazy

My dream policy would be a wealth tax that includes company ownership that could be paid with company shares. Any shares paid this way would go to an escrow that is controlled by the employees of the company, eventually trending companies towards becoming worker coops.

The 99% don’t have any unrealized gains to begin with. Even people near the top end of that scale who do have investments have all or most of them in retirement accounts where the gains eventually get taxed as income (traditional) or not at all (Roth) instead.

Unrealized gains means that the investment vehicle has increased in value since it was purchased, but hasn’t been sold at that value. Every type of investment is going to have either unrealized gains or losses until it’s sold.

Nearly every homeowner has unrealized gains in their house value.

Edit: Also, all these unrealized gains of the very rich would also be taxed when transacted, like the retirement funds, but there are loopholes. They can leverage that wealth without “realizing” the value.

deleted by creator

Yuup. Fuck my 401k. I’d trade the whole think to watch Trump finally face a single consequence.

Surely this time they’ll realise it’s Trump’s fault. 🙄

Uh huh, but worth it to who? So far all we’ve heard is some vague existential nonsense about how they have to implode the economy in order to save the economy. Based on the messaging I’ve heard all my life, “stagflation”is one of the least desirable economic modes to have under capitalism.

If we believe that the democrats didn’t properly recognize or hear the very real economic anxiety that Americans felt prior to the election, and that that disconnect in part contributed to their failure, I think we might also assume that Americans as a whole will not simply “take his word for it” that they should become homeless in order to drive crypto prices up.

If we believe that the democrats didn’t properly recognize or hear the very real economic anxiety that Americans felt prior to the election

The bothsiderists don’t typically look at what the Republicans did or didn’t do, except as a jumping off point to explain to everyone else how the Democrats are terrible at pretty much everything.

And certainly the unhinged base is so disconnected from reality that it would take quite a lot to wake them up, if it’s possible at all. The same geniuses that could see all the same stats we could under the booming economy we just had up until January of this year, now proclaim, without even flinching that donvict was handed “the worse economy ever”. We can all look at things like S&P take a gigantic downturn after donvict’s stupid games with tariffs, but these guys blame that direct cause/effect on…Biden. And people like Dollar Store Harry Potter Mike Johnson sit there and repeat the same brazen lie.

bothsiderists

Pass state level electoral reform to reduce the influence of political parties and empower the citizenry with the ability to vote outside the 2 party system without a spoiler effect. Make sides less important then policy. Introduce competition into the electoral process.

Do I really have to sell more democracy? We should naturally gravitate towards more representative electoral systems. Democrats are self proclaimed democracy advocates right? STAR or Ranked choice voting should be right up their alley then.

It’s obvious democrats understand the flaws of the voting system. I will refer you to nearly any political thread on lemmy during the previous election. Time and again people will reference the spoiler effect inherent with First-past-the-post voting. It is well understood then that the voting system is flawed. Why is there no urgency in changing how we vote?

Red states, I can understand why they would prefer and protect FPTP voting. What’s up with the blue states? Why are they using the voting system republicans prefer? Seems like a ultragigagigantic red flag to me.

Electoral Reform Videos

First Past The Post voting (What most states use now)

Videos on alternative electoral systems

Worth the cost for what, exactly? everything was okay until you opened Pandora s box and started throwing worms literally everywhere.

Your government is in chaos, your country is in chaos, you even made the World mi chaos and now you want a recession because…?

everything was okay

It certainly wasn’t. Not that Trump is going to make anything better of course; it’s worse from here on out

You where doing better then most countries in the world. But realizing inflation is happening world wide would need Americans to now there are other countries besides them.

At least this one we see coming like a train with no brakes.

😂

Sorry what?

Don’t piss on my leg and tell me it’s raining, bub.