You laugh, but this actually kinda worked for 1980s Brazil.

Interesting story but it’s also talking about how inflation was at 80% in Brazil in the 1980s, because they were printing money. What they did in 1993 with the URVs is a fascinating psychological experiment, but I’m not sure if it was the critical factor in stopping inflation. As per the article

It wasn’t the only trick, obviously. While they put URVs in place, the group of economists made the government balance its budget and slow down on money creation.

So I feel like it was basic economic policy that mostly worked, rather than printing money and trying to dictate its value.

That’s a wild tale, thanks for posting

Humans do make the rules, unfortunately only some of them get the chance to so they made the rules favor themselves.

Currency divides the value of an economy. It can only represent that total value.

… but printing more would fix problems if all the new stuff went to normal people. It would give them a larger share of their economy’s total value, at the expense of billionaires. The usual trouble is that those rich fucks also get all the new money, doubling down on how they have all of the fucking money.

there is not an item of currency attached to every asset on earth…There is vastly more real asset value than there is currency.

Modern currency is liquid float to help facilitate transactions among items having real value.

Currency itself has only one fundamental value - it’s the only thing that can be used to settle taxes. This gives it a lot of exchange value - people will accept it in exchange for real value because they know there are always people needing to pay taxes, including themselves.

Governments accepted crops. Long after the invention of currency, governments still took their cut in wheat. What kind of money is a peasant going to have? All the king’s horses eat grain. This obsession with tax is a weirdly libertarian lens on a history that’s mostly anthropology.

Fungibility is the fundamental value of currency. Gift economies and informal debt only work if you see the same people on the regular. Anywhere too populous or chaotic requires a medium of exchange - some stand-in for that liquid value. And since it’s a pain in the ass to assess variabile quality, all pressure encourages commodification, and only caring about quantity.

Currency is almost inevitable from these pressures. Even functional goods like “knife money” became symbolic coins. If the point is saying, here is a knife, not necessarily a knife we both agree has suitable innate worth, then the idea of a knife is sufficient.

I mean how would taxes explain the rai stones from Yap? There’s these giant cartoon wheels that change hands without moving. People just agree, sure, that one belongs to Seema now.

I’m not arguing in favour of libertarianism, it’s nonsense. I’m pointing out some basic tenets of credit money. In whatever form currency is, it’s always tied to state power over law and taxes. The rai stones are an OK example of it.

https://neweconomicperspectives.org/modern-monetary-theory-primer.html

The rai stones are an OK example of it.

How.

Governments accepted crops. Long after the invention of currency, governments still took their cut in wheat. What kind of money is a peasant going to have? All the king’s horses eat grain. This obsession with tax is a weirdly libertarian lens on a history that’s mostly anthropology.

States are the reason everyone uses currency. States are fundamentally an army that wields its power to pay itself, and currency is a huge force multiplier for projecting power (and therefore paying itself).

The problem with crops is that they’re hard to transport, so if you and your army try to go conquer some other land, and if the army still insists on being paid upfront (it does), then you have to haul the food, using people/animals that eat some of the food they’re hauling. Now you’re facing sharp logistical limitations analogous to the ‘tyranny of the rocket’ equation, where carrying food requires more food to feed the mules, and carrying that extra mule food requires more mules which requires more mule food.

Currency solves that whole issue. The state forces the farmers to pay tax via currency, and so the farmers need to sell their crops for currency that they can pay tax with, and so now the soldiers can buy food from the farmers with the currency the state pays them. Carrying currency along with the army during a march is a relatively simple problem.

And sure, farmers could trade with currency even if the state didn’t exist, but ultimately farmers don’t actually want to trade with others - they want to be self-sufficient (within their local community), and what few trades they do actually require (e.g. buying salt, if they live inland), can still be done with crops. And do note that salt is incredibly value-dense.

Also, currency is mostly useless for farmers - what they’d mostly want to buy is food, during a famine. But if there’s a famine, everyone is hoarding food instead of selling it. So the currency is useless to buy food. Which means other farmers would be even less willing to sell the food they’re hoarding. It’s like the opposite of “don’t look down”.

Printing more money and using it for public works or giving it directly to the poor could be a valid form of wealth redistribution that doesn’t require collecting taxes. The problem of course is capital, it’s immune to this kind of inflation, though rich people who have their wealth in debt would be hurt.

I don’t understand. What part of capital is exactly the problem?

My point was that the wealthiest people have most of their wealth in assets that are protected from inflation.

ahh right, maybe we should start trading in gold bars again

though rich people who have their wealth in debt would be hurt

Aren’t the big loans interest rates tied to inflation though?

They are, but the rate you’re offered in the first place includes the loss to inflation. Capitalists aren’t going to offer a losing deal.

Directly. Yes.

I think the problem isn’t that there is a lack of money which could be solved by printing more, but that there is a lack of money because like 6 guys have stolen most of it and piled it up under their mattresses with no intention of actually using it at any point.

Prices should be set by the king tho, the only acceptable rate of inflation is zero.

The funny irony is that because money is mostly made up bullshit anyway, we kinda could just decide to print more money and keep its value. Granted, it would take the unanimous agreement of basically everyone on this silly little planet, so the chances of this ever occurring are effectively absolute zero, but still, there is no actual rule that says we cant except for the ones we ourselves created

Well, who ever created money can just uncreate it and we end capitalism, eat the rich and have a better planet

Sure buddy…

Imagine there’s a new issue of a famous comic book being printed (the series doesn’t matter; take your pick). But the caveat is that there’s only going to be ONE copy printed. Only one in existence. That single issue could potentially be worth millions, because it’s so desirable for comic book nerds and they all want to get their hands on it. Only the wealthiest of collectors will be able to throw enough money at it to win an auction, which raises its value significantly.

Now imagine the publisher decides to make 100 copies instead. The value of that issue is now much cheaper; maybe worth several thousand dollars per comic, because there are a handful of them floating around now. Still, only wealthy collectors will be able to afford bidding on a copy, but at least the top 100 bids will win a copy. Raising the value, but not as much as if they are all bidding on a single product.

Now imagine 100,000 copies are made. Now it’s mostly a standard printing, and it’s only worth the cover price for a comic nowadays (what, like $3.99 or so?)

The more copies that are out there, the easier it is to find and acquire, and thus the cheaper its value is. Same goes for money; the more printed bills that are out there, the less value each bill has, and you’ll need more of them to afford basic products. Which is why inflation is a thing, because we’re constantly printing more money each year.

In reference to my point about comic book values, there are only about 100 copies left in existence of the first Superman comic (Action Comic #1). A single copy sold last year for $6 million, and its condition was only rated 8.5/10, which means it’s a little rough around the edges from wear and tear. Not even a pristine comic book, and it still cost millions to buy!

That same issue sold for 10 cents when it was first made in 1938, but the fact that comics were made to be read and then discarded back then means most people never held on to their comic books and their numbers have dwindled over the years. Now Superman is a huge deal - one of the best-selling comics of all time - and his first appearance in a comic book is so rare, people will spend millions just to have an original copy.

Then, imagine if the comic printing company had a guy with a gun going around demanding everyone give him an amount of comic books each year. Now suddenly everyone is looking to get the comic books, driving their values up.

This is how taxes are driving the value of modern money.

just print more of the comic

So here is how it works (in the USA):

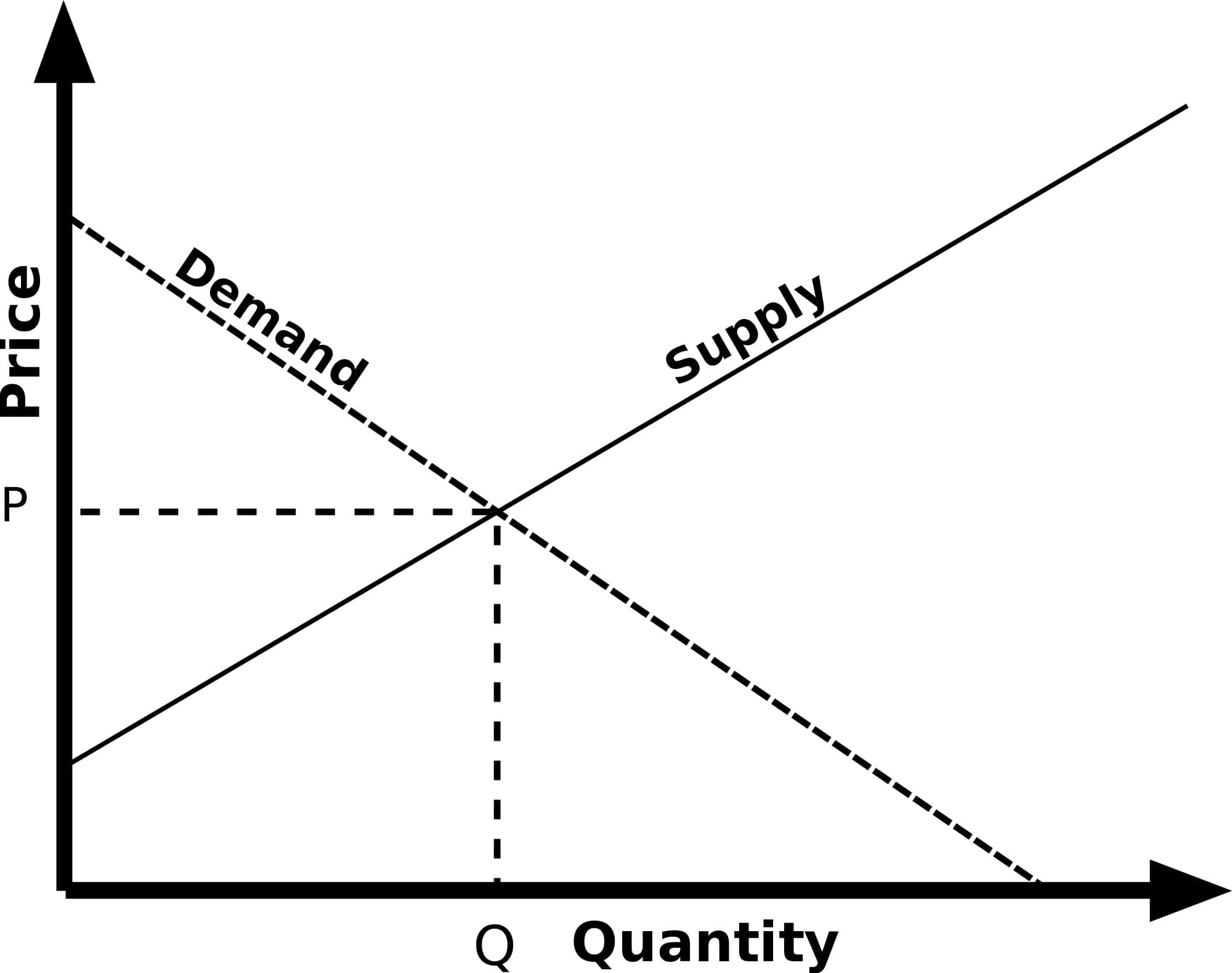

Prices of goods on a market are set by Supply:Demand Equilibrium

If a business knows they can charge more for a good or service and still sell enough to get more profit than selling them all quickly and cheaply, then they have to calculate what to sell at to optimize profits.

You can chart out the supply and the demand as a function of price with inverse correlation at varying strengths, *implying that supply will change to meet market demand so long as enough capable workforce exists to accomplish it.

Now apply this concept to Money.

If Money is plentiful and people are more willing to spend money on goods and services, then the providers of those goods and services will raise the prices to maximize the gains. In this example the regulatory bodies might use Bonds to reclaim and retire money and/or use a variety of techniques targeting loan interest rates in various ways to limit the *creation of money.

If Money is Scarce, then the prices will lower until they reach a threshold at which A) it cannot be produced for cheaper or B) somebody somewhere needs it and therefor will pay the price no matter how comparatively steep. Since these two scenarios are generally quite bad in the context of unnecessary human suffering, unprofitable goods and service industries generally receive subsidies so that regulatory bodies can keep a steady calculated amount of necessary supplies available to citizens far into the future, examples give: food, medicine, hygiene, or housing.

This also has an effect on exchange rates for trade partners. You can set a price on money. If your money is more valuable than another country’s money as a result of their willingness to purchase that money as an investment, then it makes sense to trade and buy up their cheap goods. The USA’s financial system is built around this concept of lending to struggling economies and providing data-heavy telecommunications services, built on the back of their decades of leading the pack for telecommunications technology and their leadership roles in many trade organizations including World Bank headquartered in Washington DC. Basically, the value of USD is dependent on investors in the EU and China owning US Treasury Bonds.

So it becomes obvious to most of us that creation of money can oftentimes be beneficial, but it also devalues savings and bonds, so it’s often thought a delicate balance is needed to maintain value.

-

*implying - it’s not always true that supply reflects demand in the same way that demand relies on supply, many modern economic theories revolve around the idea that Supply has much more power and therefor regulatory actions which focus on supply are more effective fiscal policies.

-

*creation of money - Loans create money. If you lend 100 dollars at 5% interest then you get back 105 dollars. While the debt is yet to be repaid, that 5 dollars exists. Debts can be traded as well. At first it doesn’t seem like it would add up to much, but in fact Bonds act as Debts and also large Loans are very very very common for the USA, and this all sort of stacks year after year until it’s reached the current point where the majority of USD is non-M1 M2 which is to say money that doesn’t physically exist: digital money and promissory notes.

Theres a lot more but I can’t be asked to teach economics.

Is this why Trump wants to annex Canada? He wants their freely made money?

You think this girl would understand anything longer than 2 sentences?

I think I lose most people around the graph.

Might be easier to just show the really slow ones a clip of the black and white footage of Germans setting wheelbarrows of their own worthless money on fire after the war.

-

Both Weimar and Zimbabwe, and all other examples of hyperinflationary economies (many Latin American countries come to mind), had large debts denominated in foreign currencies, or had fixed exchange rates with such. This makes the government depenent on aquireing these forein currencies which they themselves cannot issue. Printing your own currency to pay these debts is definately inflationary, but doing so to pay for goods priced in your own domestic currency, when there is excess productive capacity, is not.

these don’t prove that printing money always leads to currency devaluation. that’s a post hoc ergo propter hoc explanation.

Given we have multiple examples of printing money leading to inflation and eventually hyperinflation, and we have 0 examples of printing money not leading to that, it’s reasonable to conclude there is a causative link.

we print money all the time. we are basically swimming in examples of hyperinflation not happening.

We see inflation all the time. Every country that ramped up the printing during covid also saw increased inflation. Most countries stop printing before hyperinflation, we can even see in real time with Argentina that stopping the printing slows the inflation.

moving the goal posts: we were discussing hyperinflation, and now you’re saying just inflation.

My original post literally mentioned both, it’s not moving the goal posts at all. Printing money leads to inflation, printing even more leads to the end state of hyperinflation.

how many dollars do you need to print to cause a dollar to lose one penny of value?

MMT is the counter example to that, and it’s how all sovereign currency issues work right now.

In the US, taxes do not fund the government. They haven’t since at least the death of the gold standard. They act as a way to remove currency from circulation. The US just prints money and allows individual banks to print nearly unlimited money. It taxes in order to remove money from circulation and keep inflation at the target, but even then inflation isn’t necessarily connected to the amount of money available, just the perception of money available.

There’s plenty of ways to use MMT in other ways though, to print more money. If we create a function to invalidate ‘dead’ or noncirculated money, then we can print triple thr amount of money we do without raising the rate of inflation… But that would hurt rich people.

MMT is popular among politicians because it makes money seem free, but reality gets in the way when countries increase their printing and inflation goes up.

Except you have the order reversed, especially with recent inflation where inflation happened before the increase in monetary supply.

More often than not inflation under sovereign monetary issues is solely due to outside forces, not money supply.

Covid inflation didn’t happen before the increase in money supply.

It certainly did, inflation started right before the lockdowns started in response to the market shock from the rumors, and hasn’t stopped or massively slowed. It was not higher during the various stimulus packages or giveaways.

Removed by mod

Your $200 suddenly being with $100 is going to hurt a lot more than the guy with $200 billion suddenly only being worth $100 billion.

Removed by mod

Have fun buying 6 eggs for $20 under your lover trumps takeover while he actively fucks you and you keep blaming Biden for it. Fuck you’re an idiot

Removed by mod

Hey! I bought one of these for like $2 USD online nearly a decade ago. That was still almost 1000x its face value at the time.

Russia 2026

Ha ha yeah.

I remember when the official rate was $1,35 for a ruble… They even had the “cents”, the kopek.

We had a say: it’s not worth a kopek.

“No matter how times”

🤦♂️

This is literally how monet works though. It’s made up.

To be fair, Economics is half imagination and magic. It’s why something like bitcoin could even become a thing.

One of the main things I learned during my economics degree is that money is fake.

I’m proud to have properly digested how inflation works. But I still don’t understand it.

Inflation can be seen through the lens of lessening scarcity but for money.

Money is fancy IOUs, that people mostly believe will be repaid.

To quote Brian Brushwood, “It’s just pieces of paper that we believe in.”

The reason that you and everyone else believe in it is primarily because you need it to pay taxes, so the belief is not arbitrary.

You don’t need Bitcoin to pay taxes, yet belief in it continues to grow.

That is true, but Bitcoin, like all other crypto"currencies", is a Ponzi scheme. Its value is driven purely by speculation, and the hope that it can be passed on to a “greater fool” for profit. This is true for a lot of financial assets, by the way.

You don’t think secure time stamps are useful?

Thinking of how I got here, reductively speaking:

be born

see parents buy food

they use money

i grow up

need food

i use moneyI agree, but that leads to an infinite regress of your parents observering their parents, etc. My argument is really about the start of this chain.

Ah I see!

Convenience ought to have helped too! Though yes when the person with that monopoly on violence thing asks, you do.

Lots of people don’t have to pay taxes.

True, but somene has to, and they will create a demand for the currency. If I hear that Joe the baker needs money to pay taxes, and I want to buy bread from him, I know he will accept the government currency as payment for his bread. This in turn makes me demand money to be able to buy the bread.

Was not expecting to see Street-Fighter’s-Guile-as-a-magician quoted in this comment section… or at all really. He’s come a long way since Scam School, I guess.

The Modern Rogue was fun while it lasted.

And I suspect you might even suggest the only real aspect of economics boils down to supply vs demand regardless of what the thing in supply or demand is?

Definitely not. The rules behind supply and demand hinge on some extremely flimsy assumptions, namely:

- that people always act in their own best interest (they fucking don’t)

- that people can actually choose not to buy the product

For things like food, housing, medicine, etc. People don’t get the luxury of voting with their wallets, and this is why the free market cannot allocate resources effectively.

Just because I went to school for economics does not mean I am a free market capitalist. I’m definitely not.

Ah ok, I see the flaw in my thinking.

Things that are always in demand don’t drive a price solely based on supply, and since people don’t act in their own best interest the actual demand of something can’t be a useful way to determine the value of a thing.

So that sort of says to me that with a truly free market economy, it would be just as impossible to model future prices because of the inherent unpredictability of humans.

- that people always act in their own best interest (they fucking don’t)

Totally agree

- that people can actually choose not to buy the product

This is actually pretty well deacrived by what’s called the price elasticity of demand in standard neoclassical models. For things like housing one might say that the demand is very inellastic: A change in price does not affect the quatity demanded.

Yes exactly. This is why I find it funny when they use two different, yet contradictory reasons to justify the sin tax:

- it prevents people from using it because they’ll choose not to use it (the thing they’re addicted to) if it gets too expensive; and,

- the demand is very inelastic which means the government will make more revenue

When really they’re primarily taxing the things poor people are addicted to.

Idk, I’m generalizing, I’m just kind of pointing out how a lot of the supports capitalism rests on are weird little opaque excuses to convince the masses that exploitation is what’s best for us

So many economists are stuck in a box of what our society has been, they can’t think past our current rules and regulations to what could be, because they think that the rules and trends they learn in school are the only possibility, or that profit must be king.

Ehhh, not sure I’d go that far. Money, no matter what backs it, is just what people value it as. Just that when backed by real goods, e.g. gold, that it gives people a better reason to value it because the goods are worth something.

Mostly saying, money backed by a good have at least the value of the good itself. Which I would say makes money not fake.

When it’s backed by belief, then it’s fake.

But if it’s not backed by belief, it doesn’t work.

The value of those “real goods” is typically just as fake as the value of fiat currencies anyways. Trying to use things with actual usefulness as money has its own issues too.

But then said good only has as much value as we put on it. There’s a tacit acceptance of what a group of people decided that good is worth. Its value is as real as we collectively decide it is; it’s a construct

Yes, but things like gold have actual uses which give them at least some actual value. Fiat currency is backed 100% by belief.

Gold as a currency only has as much value as people assign to it. It’s really no different than a fiat currency.

Fiat currencies are actually backed by the tax liabilities denominated in them. If you are liable for one of my business cards, else a guy with a gun shows up at your door, you suddenly have demand for my business cards.

Modern money is backed by the economic power of the state issuing it, so its workers, infrastructure, education, soft and hard power. Those are definitely real things with real value.

To be fair i was being hyperbolic. Money has the power we give it. And we gave it too much.

We print money through increasing interest rates, increasing divide between rich and poor requiring the working class to take out loan after loan after loan.

Some may say interest is the cost of borrowing money, but it is money value that comes out of nothing, it’s made out of thin air and reduces the value of our dollar.

Money is made up, but it’s definitely real. Magic is made up and fake. If it actually exists and does something, it’s real. You can bring something from non-existence and make it real. It has no intrinsic value.

Definitely a fun philosophical and semantic thought experiment!

A bit subjective depending on the circumstances though right? Say a man has a horse that you want. Well, today, there probably exists a monetary figure that the man would accept to sell you his horse, even if it’s absurdly high. But let’s say something cataclysmic happens and humanity is blown back to the dark ages. If there is no society available for the man to use the money, then it really doesn’t matter how much you offer him because at that point money isn’t real. You could offer to trade good or services, but not money. You might as well be offering leaves from the ground.

That’s what the guy said. Money isn’t “intrinsically” real - it doesn’t have something in-and-of itself. It’s extrinsically real - it represents something in the society we live in, a system of arbitrage and barterage that we use to represent an amount of work (Poorly, and with little benefit to a large number of people).

So no - if the extrinsic reality changes, then the barter or arbitrage currency will change - bottle caps, for instance, take over. But for a large society to function, a commonly accepted means of representing “value” has to be agreed upon. I can’t just say, “Well, I’ve got the worth of x hours worth of time spent on projects to provide”, instead I’ll say “I’ve got x pounds to provide”.

Originally, this was made more explicit, and it still exists on UK currency: “I promise to pay the bearer…” At that point, the notes had a (Bank-enfornced) intrinsic value. The words meant a promise to provide the currencies face-value in Gold. Now, we’ve done away with gold-backed currency, and the raw value is arbitrary, it has no intrinsic value but that set by extrinsic realities.

Money is an intersubjective reality, like nations, religions, and ghosts.

Two for three.

Or there’s principles to economics that we just don’t understand yet. It’s gotten a lot more scientific since the 1970’s.

Dave Ramsey is a Jesus freak but he did have some fun truisms, one of which is if you want to know where value comes from, try taking dollar bills and bottled water into an area devastated by a hurricane and see which one has more value.

I started turning my American Dollars into Euros. Here’s hoping that mitigates the economic damage that will come from Elon’s stupidity.

Honestly, I don’t like messing around with money since I don’t really understand it…but if I don’t, I fear that I won’t be able to get onto a lifeboat. It also makes me feel silly being proactive. Here’s hoping my Blue State would either vindicate or placate my fears.

Price of gold goes Brrrrrrrrrrrrrrrtrtrtttrtrtttrrtrrtrtrttrr