Perhaps the most interesting part of the article:

Meanwhile the insurance companies are throwing parties right now for pulling out ahead of the disaster. Probably tweaking their models to make sure they’re not at risk anywhere else.

Don’t worry though, the incoming administration will be working with local governments to prepare for future challenges… Or ignoring them and dismantling any and all efforts to mitigate climate disasters. One or the other.

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

The insurance companies had an obligation to maximize shareholder value. That is the sole purpose of insurance companies.

Look, I get that this is an easy go-to answer for many things, but please add this to expand your understanding a bit more so you have a more complete picture.

Not all insurance companies are public companies with shareholders to satisfy. Mutual Insurance companies are owned by their policy holders. Specifically with California, both State Farm and Liberty Mutual have both exited too. These are both large insurance companies that are NOT driven by “shareholder value”. Profits these companies make are issues as dividends to the policy holders, not shareholders.

So the issue of insuring property in California is more than just the standard “greedy shareholders” argument.

LifeShareholders uh find a way.This is a really dumb take. Pulling out of a market where it’s impossible to even break even is not greedy or corrupt.

Yoink goes the coverage that you paid into!

And the shareholders rejoice.

Your homelessness is a you problem. You should have paid for some coverage in the event of such an occurrence.

That’s not how it works at all. You’re thinking of health insurance. This thread is about insurers declining to renew contracts, not denying claims.

This thread is about insurers declining to renew contracts, not denying claims.

So hanging around to extract insurance premiums for as long as possible, then fucking off before they have to start making any of that money flow in the other direction?

FFS, no. Do you even know what insurance is? They are always on the hook to make payouts for any policies that are active, and it happens regularly. Most of the money they take in goes toward paying claims. Most of the rest of the money goes toward overhead, which includes paying actuaries to evaluate how much risk they’re taking on and how much future payouts are going to cost. They determined that providing homeowners’ insurance in CA would soon cost them more in payouts than the state allows them to charge in premiums, so they decided to stop doing business in CA. Nobody was scammed. Their customers all got what they paid for while they were paying for it.

This reads like apologia for the insurance industry. Note the glaring absence of you mentioning their fiduciary responsibility to maximize shareholder value. I can almost see the vein on your forehead throbbing as you try to explain what insurance is to me. I understand how insurance works, but am resisting the almost overwhelming urge to reply KenM style.

Yoinking an insurance policy for my Fabrige egg collection, because I won’t stop juggling them? Cool.

Yoinking coverage for my my home, which I’m basically anchored to (proximity to work, schools etc.), while you slink off with your profits? Not so cool.

What does “uninsurable home” do to property values? The insurance companies will do fine, while I’m left to sort this out (lose everything).

I understand why they pulled out. Do you grasp the notion that home owners can’t instantly pull up stakes and teleport to more insurable locations? Do you understand how the non-insurability aggressively power-fucks those stranded home owners ability to salvage any equity in their homes?

The guillotines will be adorned with the Surprised Pikachu face.

Note the glaring absence of you mentioning their fiduciary responsibility to maximize shareholder value.

A lot of insurance companies, including big ones like State Farm and Liberty Mutual, are owned by their policy holders. So yeah, I made the mistake of not mentioning their fiduciary duty to maximize value for their customers.

Do you grasp the notion that home owners can’t instantly pull up stakes and teleport to more insurable locations?

What do you expect insurance companies to do about it? Keep offering policies and collecting premiums while knowing they won’t be able to pay all the claims they get? That’s called fraud.

You say they’re “slinking off” as if they’ve stolen something, but what have they stolen? You say they’re leaving with their profits, but what profits are you referring to? Do you really think they’d be leaving if they were making money?

deleted by creator

They do when you cram them full of black people and leave them to rot.

WTF‽

I was trying to respond to the comment I’ve copied and pasted below. Apparently Lemmy never lets you delete misplaced comments

So, projects? I would love to see a solution to home prices and the inequality they create but I think projects have been shown to work out poorly in the US.

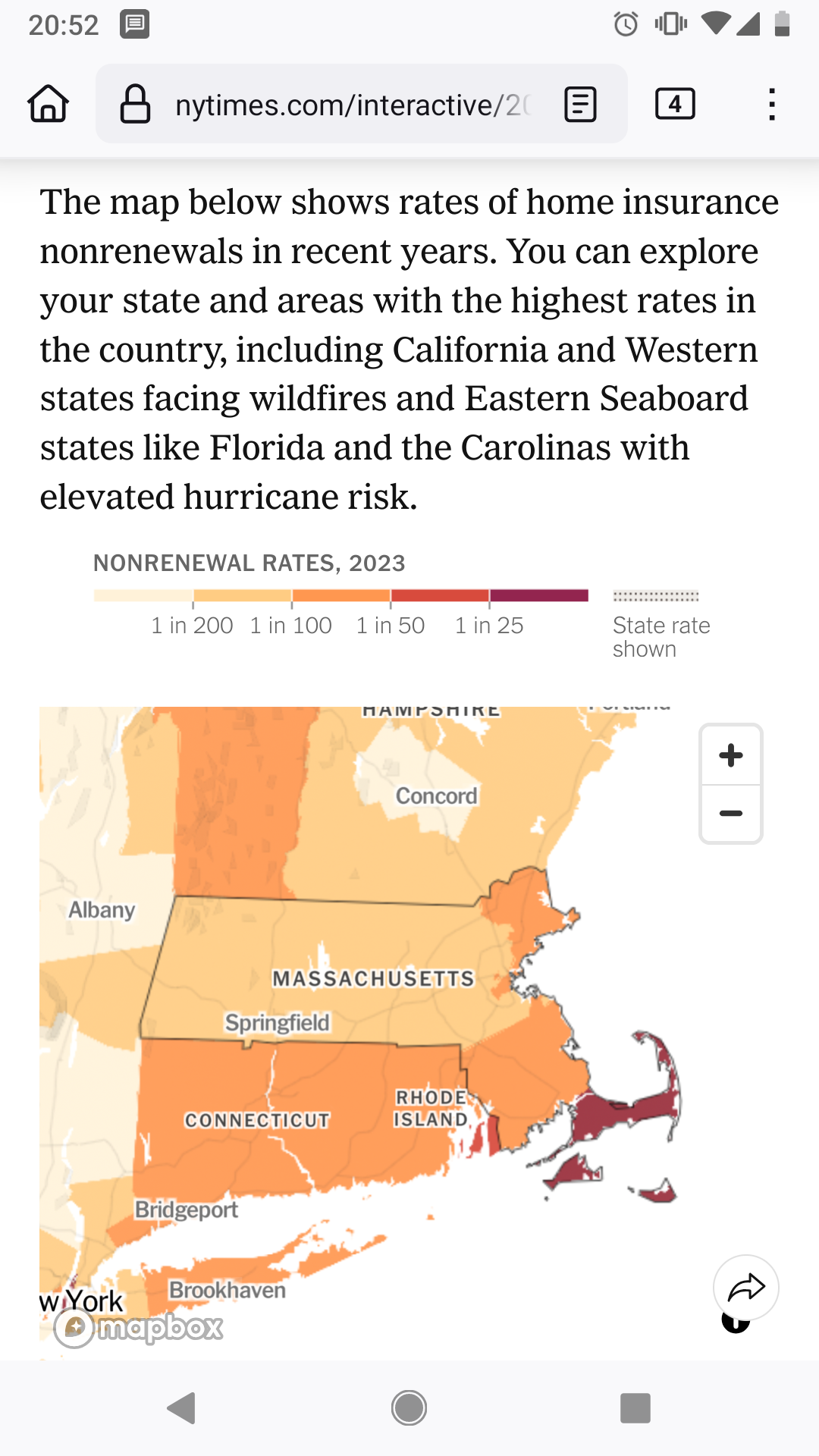

The map below shows rates of home insurance nonrenewals in recent years. You can explore your state and areas with the highest rates in the country, including California and Western states facing wildfires and Eastern Seaboard states like Florida and the Carolinas with elevated hurricane risk.

Louisiana be like, let’s add a few more refineries, and a ethane cracker plant for good measure

Ahahahahahahaha! Hahahahahahahaha!

Oh my god, get fucked rich people!

This makes me so happy.

You think everyone in LA is rich?

People with multi-million dollar houses in the Palisades, yes.

Alta Dena is most definitely not.

Still mostly million dollar plus homes. 8-12 times what my Midwestern home is worth. Hell, a freaking empty lot in Altadena is worth more than my house.

That doesn’t necessarily make them rich. The combined salaries of my partner and I would make us “rich” in some parts of the country but we rent an apartment and almost live paycheck to paycheck.

If they are not rich owning a million dollar asset, then I’m poor as fuck.

Living paycheck to paycheck doesn’t make you not rich. It just means you spend what you make. Plenty of rich people do that.

If you spend what you make, you’re not rich. You’re pretending to be rich.

What the fuck is wrong with you

Either grow up or become less of shitstain

Speaking of the Palisades fire, I’m not sure if anyone has looked into this yet, but they probably should:

Wow, really compelling stuff. Zuckerberg really is a monster

Fact-check that, Sugar-Mountain!

Oh please please, keep em coming

It’s true. I read it on the internet.

Everyone is saying it.

Climate change makes risk unpredictable; risk makes insurance unaffordable or unavailable; no insurance makes mortgages unavailable; without mortgages property values crash

Why is it without mortgages property values crash? Is it because sellers are forced to sell to only people who can pay cash? I suppose that makes sense. And of course those won’t be “people”, those will be banks and investment companies, looking to rent the property out to tenants. So more large chunks of money are siphoned away from the middle class.

If a property is at risk and uninsurable, banks won’t provide good terms for a mortgage, because ultimately the property is at risk. This means they’re either going to lower the mortgage, or increase the rates. This means less money is available to purchase the property, which forces a lower price on the seller (because nobody else could buy, unless they use cash, but why would someone pay cash on an at-risk property?).

Right, but the quote from the article specifically says mortgages will be unavailable. So forget about insurance and mortgages. (If we follow that line of thinking.) so I assume that means only cash buyers.

wow, its almost as if we should cut off the heads of insurance CEOs and nationalize them all into one low cost government plan thats paid for with pennies on the dollar in taxes.

lol, who am I kidding. Idiot Americans will always prefer paying 3000 dollars for bad coverage, rather than pay 100 in taxes for great coverage.

You had me at cutting off the heads of CEOs.

Guillotines go brrrrrrrrr

Woodchippers. Guillotines are too 18th century. Put em’ in head first.

In that case my vote would be feet first. But I think they’ve caused enough pain to deserve a little on their way out ¯\_(ツ)_/¯

With climate change, there is no option for “low cost” plan, government or no.

You can’t constantly have massive losses like these fires in a single area all paying out claims and expect to pay them off with low premiums.

I haven’t seen it in the comments yet but this is just the death spiral of climate change. Everything will just get worse from here on out as long as society operates the way it does. To everyone’s “surprise” I’m sure.

Yeah, I really do wonder when the government and rest of the people start to seriously consider if it is worth it dropping $50 billion on places like SoCal and South Florida every few years or so. At some point you need to do the math and ask hard questions about whether it is worth it, and the answer damn well may be no.

Did you pull a muscle? You know, stretching that hard to intentionally misconstrue what I said.

Seems to me that’s exactly what you said.

no, i said having a universal insurance would lower premiums significantly since there would be no corporate greed driving prices up for personal gain and everyone paying into a single pot.

But please, keep stretching. You are apparently treating this topic like a yoga class and gotta stretch stretch stretch.

Greed is bad, but its large losses in certain areas due to climate change-induced disasters that is pushing up prices far more than greed. You are the one that is stretching credulity more than a contortionist getting ready for their act.

And are you saying we should not have risk-based premiums? Sounds like you want the rest of us to subsidize living in a disaster prone area. I will gladly choose insurers that chops to drop clients in disaster prone areas so I can afford my insurance.

Yeah the point flew way over that guys head

That is what confuses me. Nationalized Healthcare, even an extensively covered one (with dental, optical, and prescription meds included) will be much cheaper overall than the private bullshit happening now.

I never understood how privatization advocates so routinely get away with bullshit. How can anyone not see how public program failures are almost always the result of deliberate sabotage.

deliberate sabotage bought and paid for by the private industry, to increase public pressure to move more healthcare to the private sector, so CEOs can make more billions.

and i have no idea. americans are fucking stupid. “Do you want to pay an extra 100 dollars in taxes for great health coverage and no declining what you need?” "NO! I WANT TO PAY 5000 FOR COVERAGE THAT DENIES EVERYTHING, BECAUSE A POOR CEO NEEDS A NEW GOLDEN TOILET ON HIS 8TH YACHT "

Or, you know, tackle climate change. But both are equally unlikely.

You’d think that insurance companies would be on the forefront of pushing climate change mitigation and prevention specifically because the impacts of worsening climate change will have a massive impact on their bottom line.

Maybe they can counter some of the petro company propaganda with their own marketing.

They’re in the business of making money, not fixing problems. It’s easier to just pull out of an unprofitable area than fix the Republican party’s head-in-their-ass ideas about climate change.

And when they run out of places to profitably insure?

TBH, if insurance companies started pushing for climate change policies it would probably make those policies less popular. If there’s an industry less trusted than Big Oil, it’s Insurance.

I’m thinking a death match between big oil and big insurance.

Their time preferences have been shortened to “this quarter” just like the rest of the economy. We would need to buy insurance plans that last decades and not renegotiate every year.

So long as we live in an economy designed to maximize GDP, this can’t work.

Why would they do that rather than just not offering plans in areas where they project they will lose money?

They’ll run out of places to sell insurance pretty fast if climate change isn’t effectively countered.

And that’s when you’ll start seeing the property insurance industry suddenly really give a shit about climate change.

BUT MUH TAXESS

Man, this thread is reminding me that Lemmy is even worse than Reddit when it comes to being populated by people who have strong opinions about things they don’t understand at all.

I FUCKING LOVE MAGNETS

How so?

So many people here are speaking as if real estate insurance companies are doing something evil by pulling out of markets where it’s impossible for them to make a profit or even break even. The companies are not reneging on any obligations, just turning away customers they can’t afford to insure, and people here are responding by saying things like all insurance is a scam, and the insurance companies abusing their customers to enrich their shareholders.

I get the feeling they’re taking their opinions of the private health insurance market and applying them to insurance in general, and in doing so they’re demonstrating a lack of understanding of what insurance is for, why it’s required for certain purchases, and why people choose to do business with insurance companies even when they don’t have to

Yeah, this is why we shouldn’t allow for-profit insurance companies in the market.

The insurance companies gotta keep their shareholders happy. That is the number 1 priority and fuck the customer.

I completely get the eat the rich mentality. At the same time, it really doesn’t make sense to rebuild some of these places. We’re all paying for it one way or another.

/a rub living in a flyover state that’s very boring from a climate change perspective, at least so far.

Absolutely, every single homeowner will pay for the insurance company losses. There are plenty of places that should have been left to nature. The entire Florida Oblast should be a National Park.

Insurance, both property and health, is completing it’s morph into a parasitic value extraction tool with zero actual use. They are committing straight fraud at this point, daring people to sue them for contract breach, knowing many won’t

I agree with the first sentence, but I don’t think there’s a lawsuit here as the contracts that you sign with them have a limited term and they are simply not renewing

Always has been.

Health insurance yes. But property insurance has a use, but these companies have ceased actually providing that service.

This is starting to feel more and more like a planned property grab.

Unfortunately whether intentional or not I think it’ll play out that way specifically for those who could not afford, with time and money, to re-build their homes and buy a new place to live.

For example, parts of Altadena, CA were exempt from redlining, so there is a majority black and brown homeowners in certain neighborhoods who have owned their homes for many years. They couldn’t afford their $1M+ house in today’s market. Insurance will pay them out, but there’s nowhere to live in Altadena now. Maybe some will lease while their home is being rebuilt, but I think many will cash out and buy a new home somewhere else, leaving a lot of opportunity for investors to buy up land and build for-profit housing.

Of course, we now know that insurance companies will not cover some of these properties so may not be a valuable investment, but the community will be forever changed, and I would be surprised if that didn’t include further gentrification.

What? How is it a property grab if no one can live there? Only the stupidest and/or richest people would buy an uninsurable home. You can’t get a mortgage without insurance, because the banks want to make sure they still have an asset to repossess if you default. Even if you were that rich, why would you throw your money away on something that will almost certainly be destroyed, sooner rather than later, without a way to recoup any of the cost? If a company like Zillow comes in and snaps up all the uninsurable homes in these regions, they’ll be declaring bankruptcy within 5 years.

I think it’s much simpler honestly: fires like these have been happening every year in California for the past hmm… at least 5 years, maybe more. Insurances are simply catching on and doing what any for-profit company would do in this situation, avoid losing money.

Malibu hills fires happened almost every year 20 years ago. Maybe not in areas with homes but it’s hardly surprising from the outside looking in. Still pity the folks.

Definitely more than 5 years. I still remember some fires back in 2009 that we’re jumping the freeways and I had to wait over a day and travel almost triple the amount of time to make it back home while being worried the whole time that my family’s house would burn down.

Yeah I said at least 5 years, cause I haven’t been here forever, and also it seems they’re getting worse in the last few years, though maybe that’s just my biased perception.

Wildfires are part of the ecology for basically the whole state. Most of the native plants here have evolved to actually depend on and co-exist with routine fire. It’s completely normal and natural for this state to burn. The problem is that for 100 years we decided that it should never ever burn at all, so there were many areas of the state that should have burned at least once every ten years that sat there and accumulated unnatural amounts of growth and fuel for ten times that long. So, when we got hit with a megadrought and a fire finally did happen in those places, it was a crazy slate-wiped fire that nothing survived instead of a manageable brush fire that plenty of things would grow back from next year.

Now, is it all bad land management? No, a bunch of shit came together at once to make this message:

-

California was caught in a mega drought for the better part of a decade and we’re still years from our groundwater returning to where it was before the drought.

-

The Japanese pine beetle killed a lot of pine trees, and that’s most of what there is in the Sierra range (yes, there are some oaks and other things, but, well, we’re getting there, hold on). So many trees died where they stood that dealing with them all was a nearly impossible task, and beetle-killed wood can’t really be used for anything (don’t ask me why, but when I was wondering why nobody had come to get all this basically free wood just laying around, that was the answer I got). So, you had huge, huge stands of beetle-kill just standing there, getting drier and drier, waiting for a spark.

-

The drought also severely dried out lots of other vegetation. There’s people I know in the Sierra who said they didn’t even have to season their fresh-cut wood. Just chuck it right in the fire, no problem.

-

Fucking PG&E decided they didn’t need to follow best practices because that costs money and spending the money your consumers pay you on stuff that isn’t bullshit makes PG&E a sad panda. So, they stopped cutting around their power lines. As someone who partly grew up in the southeast US, this fucking melted my brain. Georgia’s a pretty wet, green state, and Georgia Power clear cuts everything down to shin height for probably 50 meters to either side of their transmission lines. Humid-ass Georgia decided they needed it, but we’re totally fine to skip it in the Phoenix state, yeah, that makes sense.

So, is climate change to blame? Mostly, yes, climate change is a big, big part of why we’re here. Hotter, drier weather with shorter, more intense rain delivery means that the vegetation gets dry faster and stays dry. It means there’s less water to fight fires with. That said, it’s not the whole picture. There’s other ways we could be doing stuff better.

PG&E absolutely should have faced criminal charges for pulling that… I remember hearing it was also equipment maintenance, which the state even gave them the money to do, and they just gave it to their shareholders as dividends instead

Wonder if a nationalized or state-owned utility would have actually invested those funds properly.

-

There was a wildfire in the area last month. A couple years ago, a wildfire burned down a bunch of Malibu, a few miles away. I would be very surprised if wildfires in the area stop happening.

I think that maybe the most-reasonable solution is for insurers to just ramp rates way up unless a home is built to be extremely fire-resistant – just assume that there are going to be wildfires that dump embers in the area sooner or later, and that if your home isn’t constrained such that it is able to withstand being showered with embers without going up in flames, that it’s going to be insanely costly to insure, because it’s likely to burn sooner or later.

The problem is that it just makes more financial sense to just not insure the area. The property itself is wildly expensive and then the owners are sure to lawyer up if they don’t get exactly what they want. Makes more sense to just not issue policies.

The problem is that it just makes more financial sense to just not insure the area.

There is always going to be some price at which it makes sense for an insurer to insure a property, as long as they are not restricted in what price they can charge.

They are restricted. California has an insurance commissioner who has to approve any rate increases. It’s probably easier to stop insuring then to get the rates up to the profitability margin their risk models are suggesting are appropriate.

Even if one specific house is a concrete bunker, if it’s in the middle of normal homes, the bunker still faces potentially 1000 degree temperatures from surrounding homes, and shit’s going to burn.

You could pave everything; put in some 100-yard paved firebreaks; who know what else. Or you could just accept that there’s going to be a lot of climate refugees fleeing high risk US states. All the heads-in-sand people thinking it was just Tuvalu and Kiribati at risk going to wake up and find out it’s LA and Miami, too.

and shit’s going to burn.

Having a house next door burn doesn’t entail that your house burns. You can see video from this fire of people walking around next to houses on fire – they aren’t spontaneously combusting. Heck, I had a relative who had exactly the not-burn thing happen to them in this fire – the house next door burned down, but theirs didn’t. And it’s not hard to see that that has to be the case, or once one house in a city burns, the whole rest of the city would too. That didn’t happen even in this fire, or there wouldn’t be a Los Angeles left.

You can constrain how your house is built. You can have one of those counter-wildfire systems that has large tanks of water kept on-site and a generator-driven system that sprays it out over the property in a fire. I’m sure that there are others. They aren’t necessarily cheap and some aren’t pretty, but you can do buildings that can pull though fires.

Yeah, one house on fire next to you is probably fine, although I’ve seen that melt the siding off neighbors. All the houses on your block, especially when those houses are only separated by 6 feet, is a completely different situation.

Insurance companies wanted to raise rates… The insurance commissioner said no. So a lot are leaving.

Same for cars, getting a lot harder to find car insurance in Cali was well.

Maybe? They’re not sure if this guy is linked.

Warning: MSN link ahead:

Alleged Arsonist Arrested In Los Angeles Amid Deadly California Wildfires: What We Know

ETA: Also, 3 fires started all at once looks a little wonky in January.

Edit 2:

…though law enforcement officials have said they cannot confirm a connection between the arson suspect and any of the deadly fires currently burning through California.

One of the women involved in the citizen’s arrest, Renata Grinshpun, told local news he had a “propane tank or… like a flame thrower” and that someone saw him “behind a van, trying to light something on fire.”

Any spark that wasn’t dealt with immediately during Santa Ana’s that severe (60-100 mph gusts, constant wind around 40 mph), and during a severe drought, AND with humidity below 20% was going to blow up.

It is wonky that it happened in January, because historically that’s when we’re getting rain, but that hasn’t happened this water year. For all practical purposes we’re still in the dry season.

Yeah, but they caught a guy with a torch blower trying to start fires. I don’t know if it’s arson or not. I hope not, this is horrific.

Yeah, it sounds like he is responsible probably for the Kenneth fire, which started after the winds had died down a bit. Still enough wind to kick it off (regular 20 mph gusts), but it wasn’t hurricane force winds like Tuesday when the Palisades and Eaton fires started. I’m skeptical that any arsonist is fire happy enough to also get clonked in the head by flying debris.

I can see why you’re pretty confident, but I don’t think you can be 100% confident that these weren’t all started. We’ll have to wait and see. They’re usually pretty great about figuring out what happened.

That’s honestly really impressive. The majority of the evidence has been incinerated by thousand-degree fires and covered in sea water and firefighting foam by the time investigators get to it.

Not if their cameras were sent to the cloud before they were engulfed in flames.

Insurance companies are scummy but the headline phrasing makes it seem like they JUST canceled the policies…but no, it was 6 months ago.

As much as I want to hate them for it, can you really blame them? Insurance operates under the measured assumption that most people won’t have to use it for some major. When wildfires become probable, it’s almost guaranteed to cost them exponentially more than homeowners paid in premiums.

Even if insurance cost $50,000/year, it would take several years of payments to cover the payout. And California has wildfires yearly.

Especially for the palisades $3,500,000 homes.

At $50,000 a year it would take 70 years of payments.

Well, it should be proportional to the value they’re covering * the risk of loss, so they’re probably paying much more than $50000/year.

You don’t have to drop the entire area though, you just have to drop forest fires as a claimable item.

Then people can make a decision on if that’s okay for them, or try to find someone else.

I know some areas have laws mandating certain minimal coverages. I wonder if the insurers would even be allowed to issue policies that didn’t cover wildfires.

If that’s the case, we might see some laws changing in the near future.

Would this not most likely still cause the same kind of financial collapse in the housing market that was mentioned as a possibility in the article linked by OP? If it is not possible to get insurance for an event (i.e. wildfire) that is likely(/definitely going) to occur, then I imagine buyers/real-estate developers would be less inclined to pay high prices in those regions.

I’d think so, but just to a lesser extent?

You just can’t live any place and in such a fashion as shall certainly result in a loss

I think we’re likely to see a collapse of housing markets in places like CA and FL no matter what.

This is why insurance shouldn’t be for profit.

I think you might have missed the point.

I mean it would be great to have some kind of socialised home insurance that wasn’t “for profit”, but such a scheme should still refuse to insure homes which are likely to burn down.

That probably sounds good in your head. But you are only thinking of fires. What if they just pick the highest risk factor for every house and refuse to cover that. Then what would be the point of the insurance. And if you consider all the houses that are a high risk for something… fire, hurricane, flooding, high winds, tornadoes, earthquakes… you aren’t left with many houses.

What a silly thing to say.

Obviously, if one insurer refused to cover what ever thing, they would lose all their customers to other insurers who covered sensible risks.

The point is, you can’t insure against risks that are too likely to occur.

Let me rephrase. If they refused to insure any house that was a high risk for one factor. That would be a very sizable chunk of the country. Even if they only refused to insure it for the thing it was high risk for, it would make unsurance on the house pointless. Flood zones and wildfire zones particularly are expending every year. Hurricane zones used to be ok to insure because hurricanes didn’t hit too hard too often. But they are stronger and more frequent, so much of Florida has a very short list of insurers which will trend to zero in the near future. While I agree everyone should move out of florida because of the shitty politics, that isn’t really practical.

The cost of insurance needs to equal the risk though.

If a house is going to get burned down every year, who pays to re-build it?

It isn’t practical to expect everyone to move out of florida, but climate change is impractical.

Thats why i pointed at building codes. Require building that will survive the threat. Then people will have to pay more for them which discourages people from building in those areas at least.

Insurances need to cover their expected cost with the rates, otherwise they won’t be able to cover in case of an incident. Nobody will run an insurance expecting a loss, and you can’t force anyone to.

The alternative is like when we had flood that the state bails out the boomers who bought houses when they were cheap in areas where insurance won’t insure because of risk, paid with taxes by people like me who have a hard time acquiring property because taxes and other cost are so high due to decisions their generation and earlier ones made.

Of course, this is somewhat exaggerated; they also pay taxes. But it’s also not completely wrong.

In the particular case of a previous colleague’s house getting flooded, I always had to think of the fact that she chose to fly a certain route for work to save about 2 hours because it’s just so much more convenient than the train.

I mean it would have happened with it without her flying, but still thought about it.

They could cover a lot more if they didn’t need to make billions in profit. But your general concern is valid. What stops people from building in extremely high risk places. The answer should be federal building standards. If a house is built in a high risk area, it must have mitigating features that protect it from the high risk, or it can’t be built. Local building codes already do this sort of thing. So this is just an extension of something already done. Most people don’t know which areas are high risk for what. So don’t penalize them for getting duped. And in many cases the house wasn’t in a high risk area when built. So there needs to be funding to upgrade those houses to reduce the risk. That should come from the industries that profitted on ignoring the effects of thier industry in exchange for great profits.

As much as I want to hate them for it, can you really blame them?

Yes; go sue big oil who fucking knew since the 60’s climate change was inevitable if nothing changed. Make those fuckers pay dearly.

For some reason you made me think of banks being covered by government insurance. In a way you’d think the government would also insure land, seeing as that’s one of the main things they protect.

The logistics would probably be horrible for that type of thing though.

Government can print money when appropriate and not abused. Payments directly to the general public are the best type of stimulus. Take a bad situation and make it a stimulus.

Part two though has to be that they are not allowed to receive a payout more than once or make it illegal to build new construction in wildfire zones until they have figured out the forest management issues.

There aren’t really forestry issues at all.

Practically everywhere is a wildfire zone though. Yes we need much more forest management, infrastructure hardening, fire resources, etc, but giving folks a one time payout and then they move to another area that gets destroyed and now they don’t get support doesn’t seem helpful since we can’t really predict what will burn. It’s simply harder than e.g. flood mapping.

I think the curious aspect of this is that business is absolutely aware, and acknowledges existence of the climate change.

They should be putting in effort to reduce climate change impacts. It’s in their financial interest, even if they have no capability to have a moral motivation

I’m pretty sure these gamblers will profit all the way down.

If they run out of people/places that are profitable to insure any more, there won’t be any profits to make.

lol dude climate change has been in companies’ drawers since the 1970s, for example shell and such. they just acted as if they didn’t know to continue selling at record speeds.